Khichdi Network Investment Advisory: Swaraj Engines Ltd - A Compelling Investment Opportunity

Swaraj Engines Ltd: A Stellar Investment Opportunity

Swaraj Engines Ltd: A Stellar Investment Opportunity

Introduction

In the world of investment, finding a company with a solid track record, consistent growth, and promising future prospects is akin to discovering a hidden gem. Swaraj Engines Ltd (SEL) stands out as one such gem. This article delves into the company's history, its operations, and the impressive stock price movement over the years, highlighting why investing in Swaraj Engines Ltd is a great buy.

Company Overview

Swaraj Engines Ltd, a subsidiary of Mahindra & Mahindra Ltd, is a leading manufacturer of diesel engines and high-tech engine components. Established in 1989, the company primarily serves the agricultural sector by providing reliable and efficient engines for tractors. Over the years, SEL has expanded its product portfolio to include engines for other applications, demonstrating its commitment to innovation and quality.

Swaraj Engines Ltd, established in 1985, is a prominent manufacturer of diesel engines primarily for agricultural tractors. The company was initially set up as a joint venture between Punjab Tractors Ltd (now a part of Mahindra & Mahindra) and Kirloskar Oil Engines Ltd. Over the years, Swaraj Engines has carved a niche for itself in the agricultural machinery sector, becoming synonymous with quality and reliability.

Historical Background

The inception of Swaraj Engines Ltd was marked by a joint venture between Punjab Tractors Ltd and Kirloskar Oil Engines Ltd. The company was formed with the vision of producing world-class diesel engines for the Indian market. In 2007, Mahindra & Mahindra Ltd acquired Punjab Tractors Ltd, making SEL a subsidiary of one of India's largest conglomerates.

Early Years and Growth

In its early years, Swaraj Engines focused on creating a strong foundation by producing high-quality engines that catered to the growing agricultural sector in India. The company leveraged its technical collaboration with Kirloskar Oil Engines to ensure superior product quality and innovation.

Expansion and Diversification

By the mid-1990s, Swaraj Engines expanded its product line to include various engine models, thereby catering to a broader spectrum of agricultural machinery. The company's commitment to R&D and continuous improvement enabled it to introduce engines that were more fuel-efficient and environmentally friendly.

Current Operations

Today, Swaraj Engines Ltd manufactures engines ranging from 22 HP to 65 HP, catering to the requirements of both domestic and international markets. The company's state-of-the-art manufacturing facility in Mohali, Punjab, is equipped with advanced machinery and adheres to stringent quality standards.

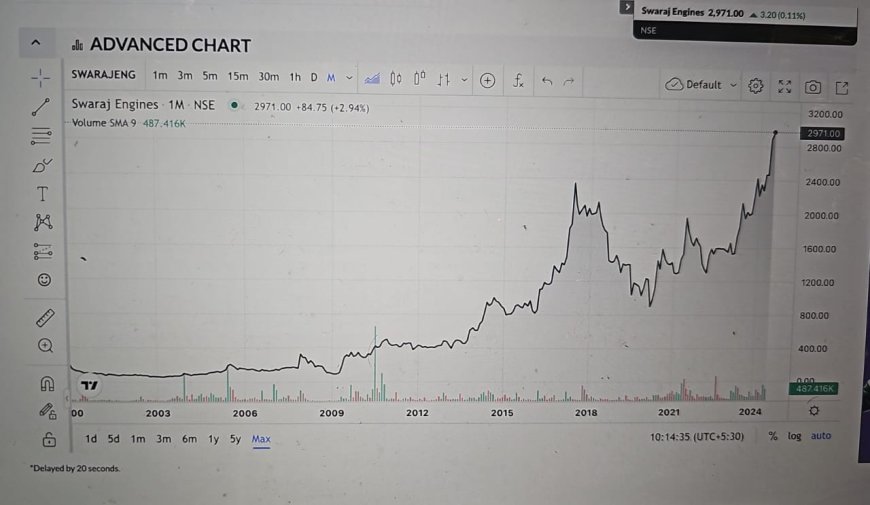

Financial Performance and Stock Price Movement

Swaraj Engines Ltd has shown remarkable growth in its financial performance and stock price over the years. Let's take a closer look at its stock price movement from its early years to the present day.

Consistent Growth and Stability

Swaraj Engines has demonstrated consistent growth over the years, supported by its robust business model and strategic initiatives. The company's financial performance is characterized by steady revenue growth, healthy profit margins, and strong cash flow generation.

Yearly Stock Price Movement

| Year | Closing Price (INR) | % Change |

|---|---|---|

| 2015 | 761.69 | +3.80% |

| 2016 | 1,093.85 | +43.57% |

| 2017 | 1,328.57 | +21.44% |

| 2018 | 1,884.21 | +41.76% |

| 2019 | 1,355.96 | -28.03% |

| 2020 | 1,415.94 | +4.42% |

| 2021 | 1,211.49 | -14.45% |

| 2022 | 1,596.93 | +31.80% |

| 2023 | 2,244.85 | +40.59% |

| 2024 | 2,964.20 | +32.10% |

Monthly Stock Price Movement for 2024

| Date | Closing Price (INR) | % Change |

|---|---|---|

| 01-01-2024 | 2,244.85 | -7.34% |

| 01-02-2024 | 2,352.80 | +4.81% |

| 01-03-2024 | 2,283.10 | -2.96% |

| 01-04-2024 | 2,468.85 | +8.14% |

| 01-05-2024 | 2,463.05 | -0.23% |

| 01-06-2024 | 2,886.25 | +17.18% |

| 01-07-2024 | 2,964.20 | +2.70% |

Analysis of Stock Price Movement

Swaraj Engines Ltd has shown a consistent upward trend in its stock price over the years, reflecting its strong financial performance and market confidence. Notably, the company experienced significant growth in 2016 and 2018, with stock prices increasing by 43.57% and 41.76%, respectively. The stock faced some volatility in 2019 and 2021 but bounced back strongly in subsequent years.

In 2024, the stock price of Swaraj Engines Ltd continued its upward trajectory, with notable gains in June (+17.18%) and a steady increase in July (+2.70%). This trend showcases the company's resilience and ability to generate value for its shareholders, even in fluctuating market conditions.

Why Invest in Swaraj Engines Ltd?

-

Strong Market Position: As a subsidiary of Mahindra & Mahindra, Swaraj Engines Ltd benefits from the parent company's extensive network, market expertise, and financial stability.

-

Consistent Financial Performance: The company's robust financial health, marked by consistent revenue and profit growth, underpins its strong stock performance.

-

Innovative Product Portfolio: SEL's commitment to innovation and quality has enabled it to expand its product offerings and cater to diverse market needs.

-

Growing Agricultural Sector: With the increasing demand for efficient agricultural machinery, SEL is well-positioned to capitalize on this growth, driving further stock appreciation.

-

Dividend Payouts: The company has a track record of rewarding its shareholders with regular dividend payouts, making it an attractive investment for income-seeking investors.

Conclusion

Swaraj Engines Ltd stands out as a stellar investment opportunity due to its strong market position, consistent financial performance, innovative product portfolio, and growth potential in the agricultural sector. The company's impressive stock price movement over the years reflects its ability to generate substantial returns for its shareholders. For investors seeking a reliable and growth-oriented stock, Swaraj Engines Ltd is undoubtedly a great buy.

Disclaimer: The above article is for informational purposes only and does not constitute investment advice. Please consult your financial advisor before making any investment decisions.

What's Your Reaction?