Introduction to Cash & Cash Equivalents for Kids & Adults

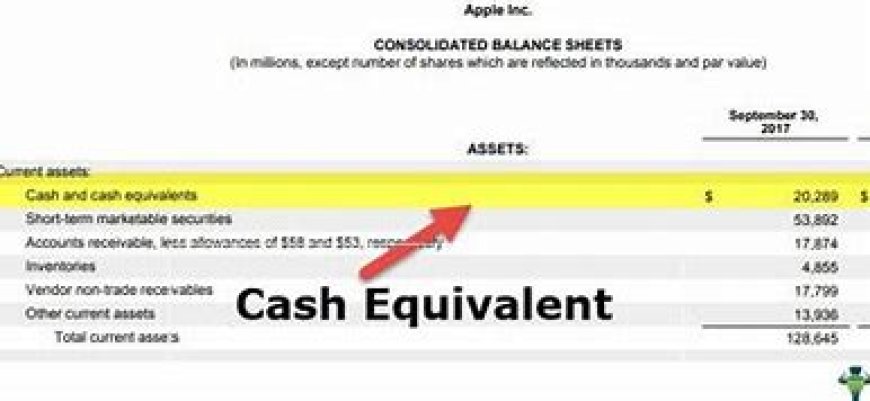

Cash and cash equivalents are financial assets that are readily convertible into cash. They represent liquid resources that a company or individual holds for short-term use or to meet immediate financial obligations.

Cash:

Cash is the physical money we use for daily transactions. It includes coins and banknotes. For example, if you have Rs. 100 in your pocket, that's cash. You can use it to buy things like snacks or toys directly.

Bank Deposits:

When you keep your money in a bank account, it becomes a cash equivalent. It's like having your money stored in a safe place that you can access whenever you need it. For instance, if you deposit Rs. 500 in a savings account, it becomes a cash equivalent because you can easily withdraw or use that money when required.

Fixed Deposits:

Fixed deposits, also known as FDs, are another form of cash equivalent. It's like giving your money to a bank for a fixed period, such as 6 months or 1 year. In return, the bank pays you an interest rate. After the fixed period ends, you can get back your initial money plus the interest earned.

Short-Term Investments:

Certain short-term investments with maturity periods of three months or less, such as commercial papers or marketable securities, are classified as cash equivalents. These investments provide a higher return compared to traditional bank accounts while still maintaining a high level of liquidity.

Post Office Savings:

In India, post offices offer various savings schemes where you can deposit money and earn interest. These post office savings schemes, like the Post Office Savings Account or the Public Provident Fund (PPF), act as cash equivalents. They allow you to keep your money safe and earn interest over time.

Cash and cash equivalents are important components of a company's balance sheet as they represent the company's ability to meet short-term obligations and finance day-to-day operations. They provide a cushion of readily available funds for emergencies or unexpected expenses.People often keep a portion of their savings in cash or cash equivalents for immediate use while considering other investment options for long-term growth.

Examples for Kids:

Piggy Bank:

A piggy bank is a simple example of cash. Kids often have piggy banks where they collect coins and notes. It's like a small safe for their money. When kids need to buy something, they can take out the cash from their piggy bank and use it for the purchase.

Wallet:

A wallet is another example of cash. Parents carry wallets that hold money in the form of coins and notes. When kids go shopping with their parents, they might see their parents taking out cash from their wallets to pay for groceries or other items.

Savings Account:

A savings account is like a special bank account where you keep your money. Kids can have their own savings accounts where they can deposit money they receive as gifts or allowances. The money in the savings account is easily accessible and can be used for buying toys or saving for something special.

School Tuck Shop:

In schools, there are often tuck shops where kids can buy snacks or small items during break time. Kids can bring cash from home, such as Rs. 10 or Rs. 20, to buy their favorite snacks or drinks at the tuck shop.

Birthday Gift Money:

During birthdays, kids often receive money as gifts from family and friends. This money is like cash, and kids can decide how to spend it. They might save it in their piggy bank or use it to buy something they have been wanting.

Examples for Layman Adults:

Wallet:

For adults, a wallet is also a common way to carry cash. They can keep coins and notes in their wallets for everyday expenses like buying groceries, paying for transportation, or dining out at a restaurant.

Fixed Deposit:

A fixed deposit, also known as an FD, is a popular cash equivalent for adults. It's like lending money to a bank for a fixed period, such as 1 year or 3 years. The bank pays interest on the fixed deposit, and at the end of the fixed period, adults can withdraw the money along with the interest earned.

Savings Account:

Similar to kids, adults can have savings accounts in banks where they can deposit their money. The money in a savings account is easily accessible and can be used for various purposes, such as paying bills, buying necessities, or saving for future goals.

Cash and cash equivalents, in the Indian context, refer to the amount of money a company has readily available in the form of cash and easily convertible assets. It includes cash in hand, money in bank accounts, and short-term investments that can be quickly turned into cash when needed. Essentially, it represents the company's cash on hand that it can immediately use for various purposes like paying bills, meeting expenses, or investing in opportunities. Having a sufficient amount of cash and cash equivalents is important for a company's financial stability and ability to handle short-term obligations. It ensures that the company can smoothly operate its business and manage its expenses without relying heavily on external sources of funding.

What's Your Reaction?